New federal data reveal where retirement checks lose buying power the fastest and which metros still let them breathe.

If you’re counting on a monthly Social Security payment to carry you through retirement, where you live could be the difference between comfort and constant belt‑tightening. A fresh LendingTree analysis that stitches together figures from the Social Security Administration, the Bureau of Labor Statistics, and the Tax Foundation shows the average benefit—about $21,500 a year—covers barely 30 percent of typical retiree expenses nationwide. In some spots, that share tumbles below 25 percent. So, what should future retirees watch for?

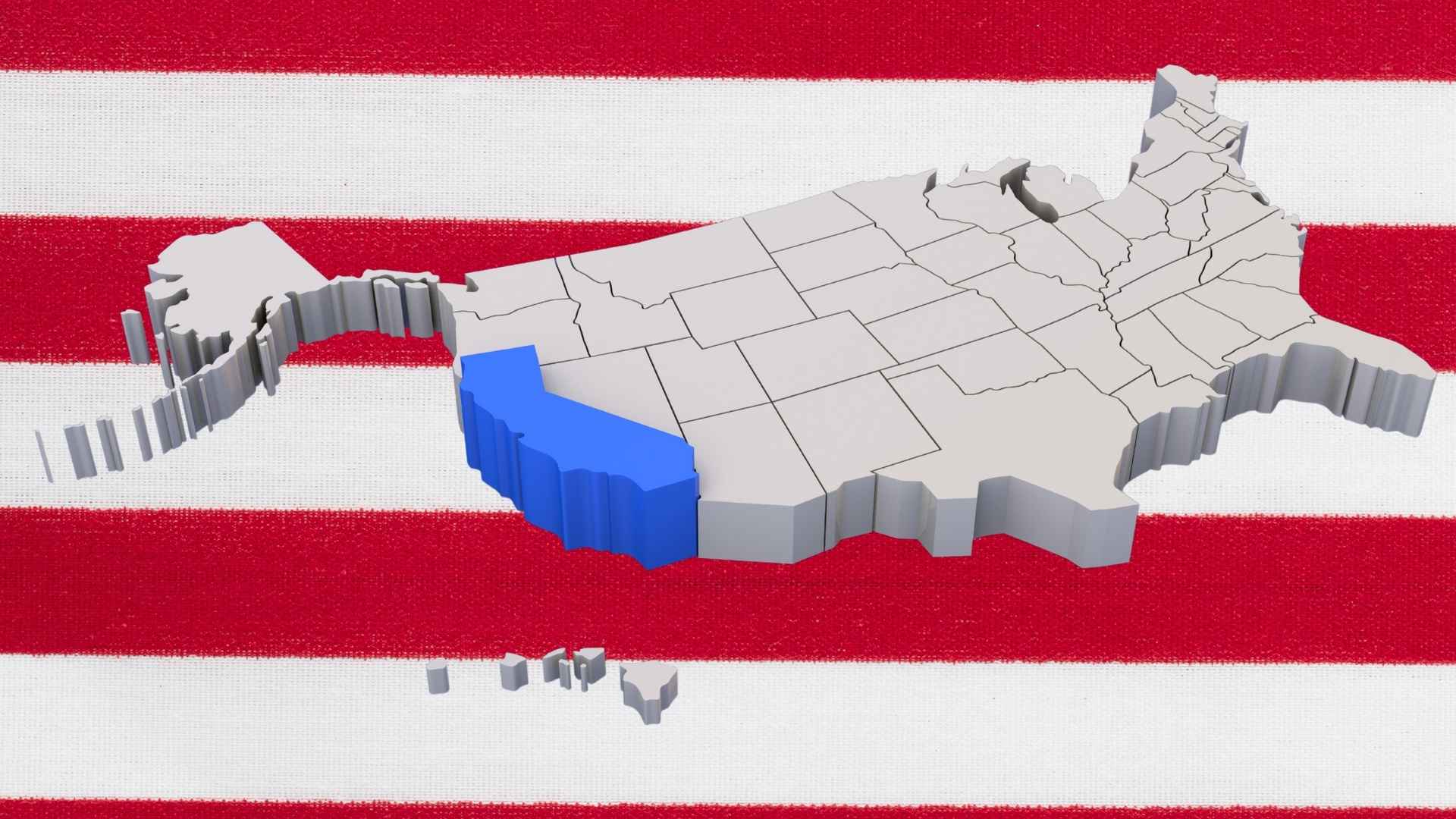

Cities where social security checks cover less than a quarter of expenses

The research ranks metros by how much of their average annual spending is paid for by Social Security alone. In the priciest ten, retirees are forced to bridge a yawning gap:

| Rank | Metro area | Share of costs paid by Social Security |

|---|---|---|

| 1 | San Francisco, CA | 24.3 % |

| 2 | Los Angeles, CA | 24.9 % |

| 3 | Washington, D.C. | 24.9 % |

| 4 | San Jose, CA | 24.4 % |

| 5 | Oxnard, CA | 25.3 % |

| 6 | San Diego, CA | 25.7 % |

| 7 | Sacramento, CA | 26.4 % |

| 8 | Riverside, CA | 26.6 % |

| 9 | Stockton, CA | 26.7 % |

| 10 | Miami, FL | 26.9 % |

Notice a pattern? California dominates, but the nation’s capital and Miami also squeeze retirees. Ouch.

Affordable metros offering retirees the highest share of Social Security income

Thankfully, several inland and midsize cities stretch benefits more than one‑third of the way toward annual budgets:

- McAllen, TX – 34.6 %

- Buffalo, NY – 33.1 %

- El Paso, TX – 32.9 %

- Syracuse, NY – 32.8 %

- Scranton, PA – 32.7 %

- Wichita, KS – 32.6 %

- Augusta, GA – 32.4 %

- Tucson, AZ – 32.3 %

- Little Rock, AR – 32.3 %

- Tulsa, OK – 32.3 %

Cheaper housing, lower taxes, and moderate grocery bills help these metros punch above their weight.

Planning moves now can prevent sticker shock later in retirement

Most economists agree that checks alone will not cut it, especially in coastal hubs. Therefore, start stockpiling savings early, slash high‑interest debt, and think twice about settling in an ultra‑expensive ZIP code. Could relocating—or even snow‑birding—add breathing room to your budget? Many retirees find that swapping a high‑rent postcode for a lower‑cost town frees up cash for medical bills, travel, or simply peace of mind.

Your Social Security check is fixed, but your address isn’t. Comparing cost‑of‑living data before you retire can make the difference between scraping by and sailing through your golden years. Choose wisely, and your benefits can work harder for you—no matter what the price tags look like in California.