Late wages spark dispute over ‘tone’ and underline workers’ right to prompt payment.

When an employee noticed their paycheck was running a full two weeks behind schedule, they asked the boss what was going on. Instead of an explanation, the worker walked away with a written warning for an “unprofessional attitude.” The money arrived two days later, but the write‑up stayed on their record, raising fresh concerns about wage security and retaliation.

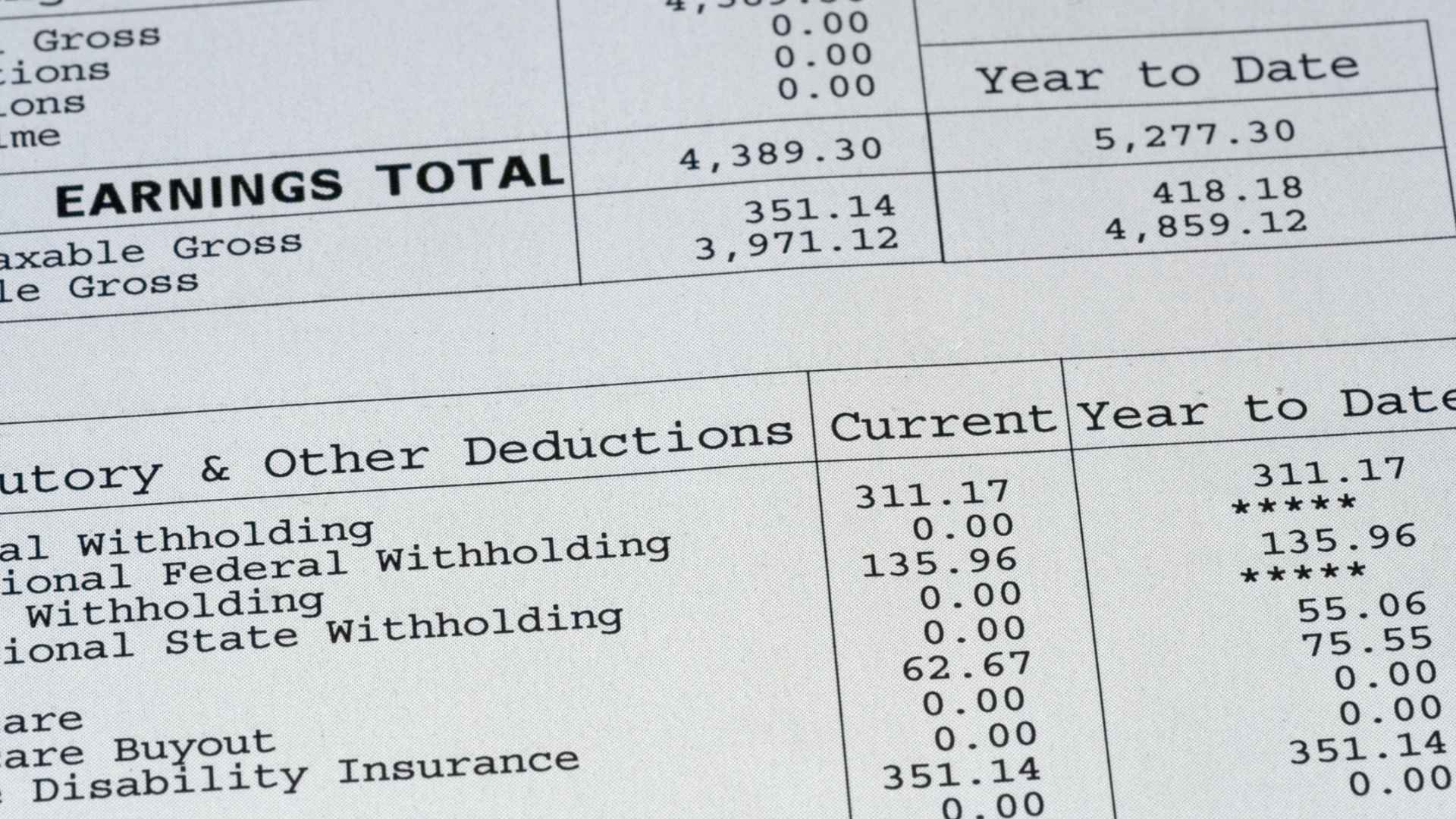

Pressure builds fast when rent, groceries, and gas all depend on an on‑time deposit. After all, who can budget around mystery paydays? Advocates note that even a one‑day delay may breach state payday laws, while a two‑week lapse could hint at deeper cash‑flow trouble.

Why a two‑week late paycheck triggers rightful concerns under labor law

Under the Fair Labor Standards Act, employers must pay for every hour worked, yet payday schedules are set by the states. Most require wages at least twice a month; some insist on weekly distribution. Miss the window and penalties—including liquidated damages—can follow. No wonder the worker’s eyebrows shot up—wouldn’t yours? Late checks also suggest shaky finances that threaten future payrolls.

How management’s ‘unprofessional attitude’ citation may conflict with wage protections? Retaliating against employees who ask about pay can backfire. Federal and state statutes bar discipline that chills a lawful wage complaint. Labeling a straightforward question as “unprofessional” may look a lot like retaliation if the matter ever reaches the Labor Department or a civil court

| Event | What happened |

|---|---|

| Scheduled payday | Check fails to appear |

| Two weeks later | Worker asks about missing wages |

| Same day | Supervisor issues formal warning citing tone |

| Two days later | Paycheck finally delivered; warning remains |

The table shows how a routine inquiry escalated once management chose discipline over dialogue.

Steps employees can take when employers delay payment and issue write‑ups

Wondering what to do if your own check goes missing? Start with the tips below, then decide whether firmer action is needed.

- Document everything: keep emails, texts, and pay stubs.

- Check state laws: each labor department posts local payday rules.

- File a wage claim: most states offer free administrative complaints.

- Consult an attorney: many wage cases proceed on contingency.

- Stay professional: stick to written communication and avoid personal attacks.

After following these steps, many workers recover unpaid wages without a courtroom visit. However, if a company doubles down with retaliatory write‑ups, formal legal action may be the only path forward.

Prompt pay isn’t a perk—it’s the law. Delays can set off financial dominoes for employees, and punishing someone for asking about their money only magnifies the risk. Therefore, employers should treat timely payroll not as courtesy but as core compliance.