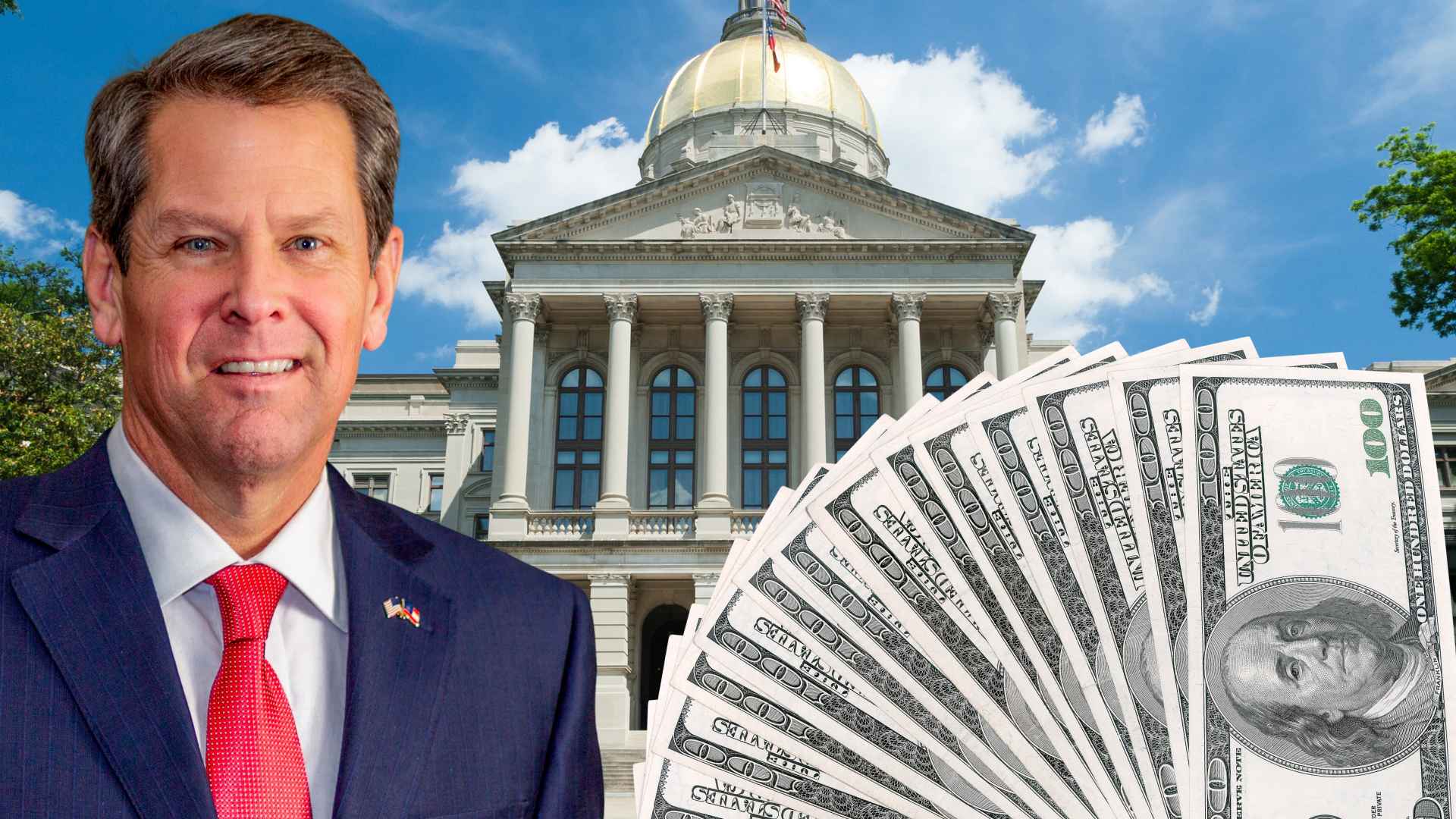

Extra cash on the horizon as the Peach State returns a $1 billion budget surplus to residents. Georgia taxpayers are about to feel a welcome bump in their bank accounts. A new refund program, backed by Governor Brian Kemp and funded by this year’s $1 billion budget surplus, will send up to $500 to eligible filers. In a year when grocery bills and gas prices still sting, that’s no small change.

First up, the basics: lawmakers set aside part of the surplus specifically for direct relief. The Department of Revenue will handle distribution, and most payments should arrive within six to eight weeks of processing—either by direct deposit or paper check.

Who qualifies for Georgia’s new one‑time $500 surplus refund payments

Wondering if you made the cut? The state kept the eligibility list short and sweet. To claim the money, you must:

- have filed 2023 and 2024 Georgia income‑tax returns on time (May 1 or Oct 15 with an extension);

- have owed at least some state income tax for 2023;

- be a full‑year resident, part‑year resident, or non‑resident who files in Georgia.

If that sounds like you, take a look at the payout schedule below:

| Filing status | Refund amount |

|---|---|

| Single or married filing separately | $250 |

| Head of household | $375 |

| Married filing jointly | $500 |

Flat amounts keep things simple; income level doesn’t change the figure. Therefore, anyone meeting the basic requirements can count on the same dollar total for their status.

Key dates and payment amounts every Georgia taxpayer should mark right now

Timing matters. Payments start processing once 2024 returns are on file, so late filers could wait longer. The Department of Revenue advises residents to check its online Surplus Refund Checker for real‑time updates—handy if you’re already refreshing your account. Need a quick recap before you log off?

- May 1, 2025 – regular filing deadline.

- Oct 15, 2025 – extension deadline.

- Six to eight weeks – estimated delivery window after return acceptance.

Other states, including New York, are rolling out similar rebates, but Georgia’s program stands out for speed and size. Consequently, taxpayers should act promptly to secure their share.

First, confirm your 2024 return is submitted. Then keep an eye on your mailbox—or that familiar “pending deposit” line in online banking. Got friends who filed late? Remind them; free money rarely waits forever.

In short, the surplus refund offers timely relief while inflation continues to bite. A $500 boost might not cover every rising expense, yet it can help families breathe a little easier.