A headline‑making pledge of $5,000 per taxpayer has collapsed, piling fresh pressure on an already fragile Social Security system.

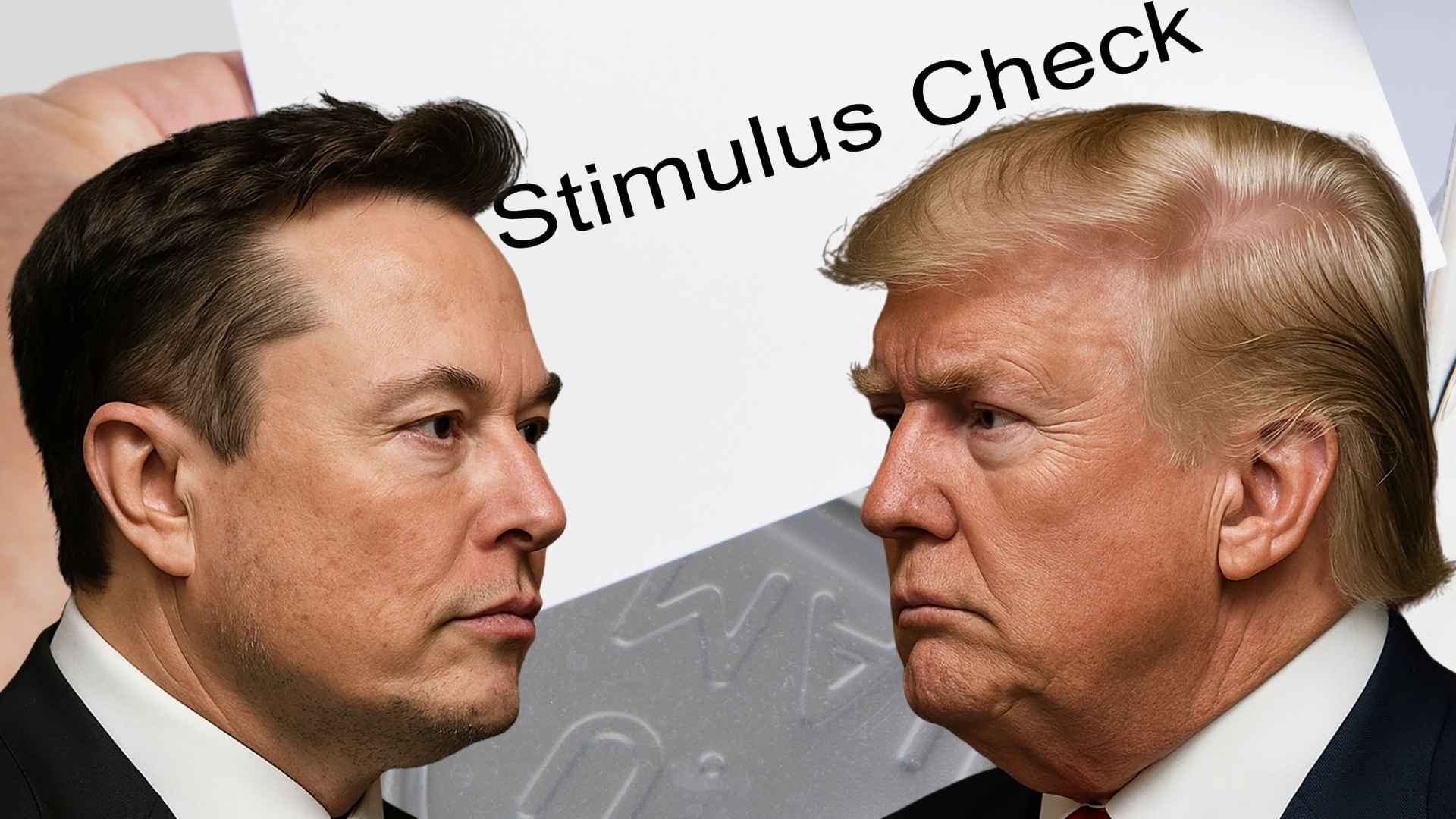

President Trump’s Department of Government Efficiency (DOGE) vowed to cut $2 trillion in waste and hand 20 percent to households earning at least $40,000. By May, the savings were a fraction of forecasts and the “DOGE Dividend” was shelved.

DOGE Dividend collapses as projected $2 trillion savings shrink to $35 billion

How did a splashy promise shrink to a mere $89? Independent auditors tallied only $170 billion in gross savings and—after service‑cut losses—just $35 billion net. That slashed the pledged windfall to roughly $89, a figure no lawmaker would back.

House Speaker Mike Johnson labeled the idea “fiscally irresponsible” with debt past $36 trillion. Elon Musk exited his DOGE post in April, and the plan slipped off the docket.

| DOGE timeline | Targeted savings | Verified savings | Resulting check |

|---|---|---|---|

| Jan 2025 launch | $2 trillion | — | $5,000 pledge |

| May 2025 audit | $170 billion | $35 billion net | ≈ $89 estimate |

| July 2025 status | — | Plan withdrawn | No payment |

Social Security Fairness Act and scrapping of WEP and GPO deepen fund crisis

Meanwhile, Congress must confront a stark Social Security Administration report. The Old‑Age and Survivors Insurance Trust Fund, already on a tight timeline, now faces added stress after the Social Security Fairness Act repealed the Windfall Elimination Provision and Government Pension Offset.

Analysts Michael Ryan and Marthe Shedden say the move helps certain public‑sector retirees but trims offsets needed to keep the fund solvent. One group’s relief, they caution, could be another’s headache.

What beneficiaries should know about future COLA adjustments amid mounting shortfalls

Wondering whether your 2026 cost‑of‑living bump is safe? With revenue squeezed and the DOGE savings gone, lawmakers may soon weigh higher taxes or trimmed benefits. Either path could dent next year’s COLA formula, which already trails rising housing and medical costs.

Right now, credible information—and a flexible plan—may prove more valuable than a vanished $5,000 check.