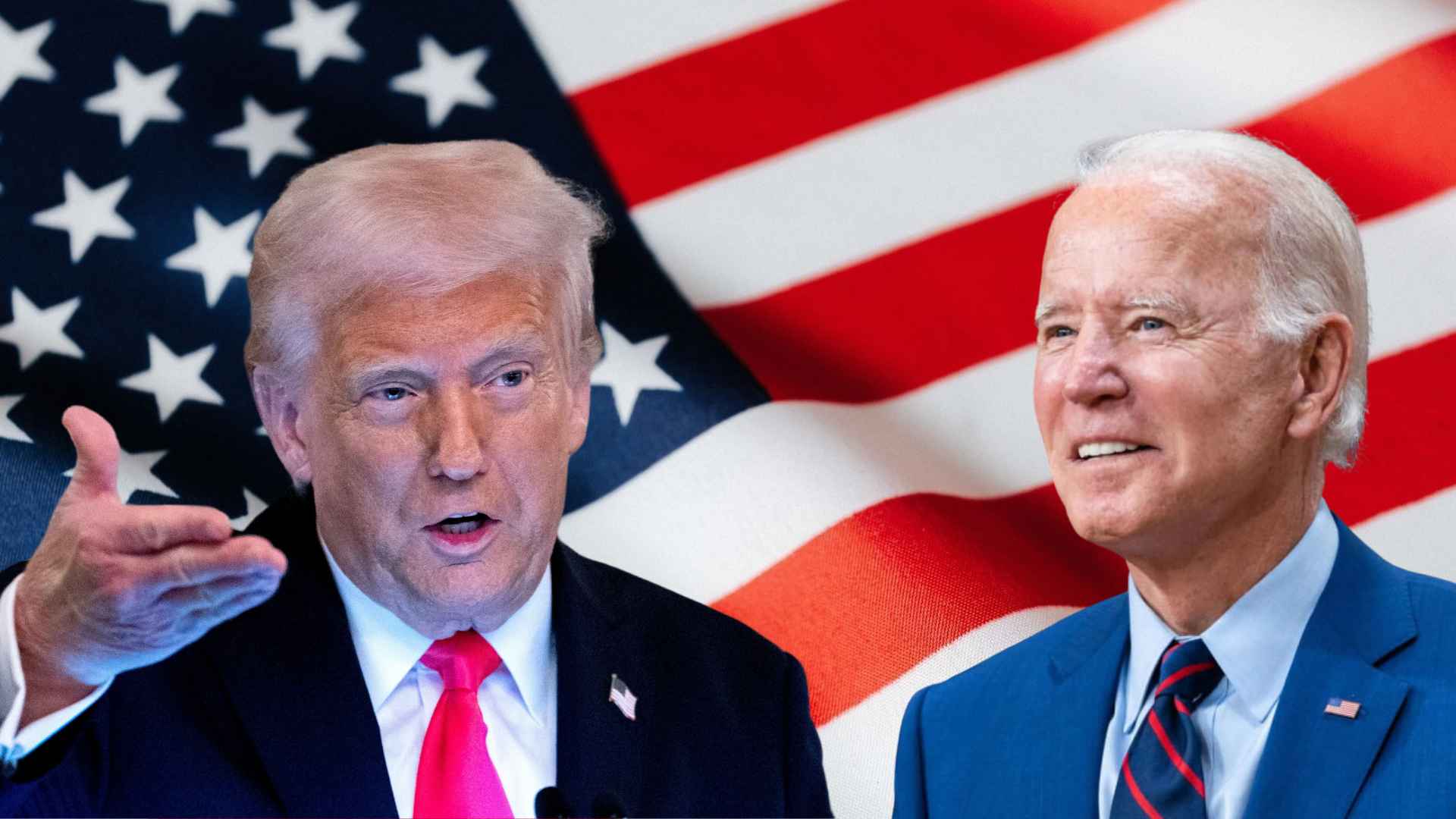

Major reversal threatens retirement Income for many older Americans. Retirees who have defaulted on their student loans could soon see their federal benefits dip as low as $750 a month. This stark change, triggered by the Trump administration’s revival of an older garnishment rule, comes after a Biden-era provision had planned to shield a significantly higher share of Social Security checks from debt collection.

In recent years, seniors with overdue loan balances benefited from temporary policies that paused federal collections. However, those protections ended in May 2025, reopening the door to wage garnishments, seized tax refunds, and deep cuts to Social Security income. Are you wondering how this might affect your own retirement plans?

Why older Americans with defaulted student loans face major Social Security reductions

Under President Joe Biden, defaulted borrowers were set to keep monthly benefits up to 150% of the federal poverty line (about $1,883). Yet the Trump administration has restored a 1996 standard that protects only $750 per month. That figure has not been adjusted for inflation and now falls below the poverty threshold. A Consumer Financial Protection Bureau report finds roughly 452,000 older Americans could be forced to live at or near this reduced level, raising concerns about spiraling medical bills and everyday expenses.

In the final days of Biden’s presidency, officials at the Education Department had pushed for a higher garnishment floor, but that proposal never took effect. Consequently, seniors can lose up to 15% of their monthly benefit, as long as $750 remains untouched. Unfortunately, skyrocketing living costs mean $750 barely covers basics such as groceries and utility bills.

Inflation’s impact on the longstanding $750 garnishment floor for Social Security benefits

When the $750 protection was introduced, it was slightly above the monthly poverty guideline. Today, it lags behind inflation by hundreds of dollars. Even Supplemental Security Income, designed for low-income recipients, offers $914 per month in 2024, outpacing the garnishment floor. So what are older borrowers to do in this situation? Below is a brief comparison of past and current safeguards:

| Policy Era | Monthly Benefit Protected | Inflation Adjustment |

|---|---|---|

| 1996-era Policy | $750 | None |

| Biden-era Proposal | $1,883 | Yes |

Some lawmakers are championing legislation to suspend garnishment for older borrowers, emphasizing that no retiree should risk poverty over student debt. However, until new measures pass, many seniors remain vulnerable to having a significant portion of their retirement checks withheld.

In closing, the policy shift to a $750 floor has far-reaching implications for those in default. Beneficiaries facing this reduction might consider seeking advice on repayment plans or researching loan-forgiveness options if they qualify. Staying informed, exploring relief programs, and contacting your loan servicer promptly could help ease the financial strain.