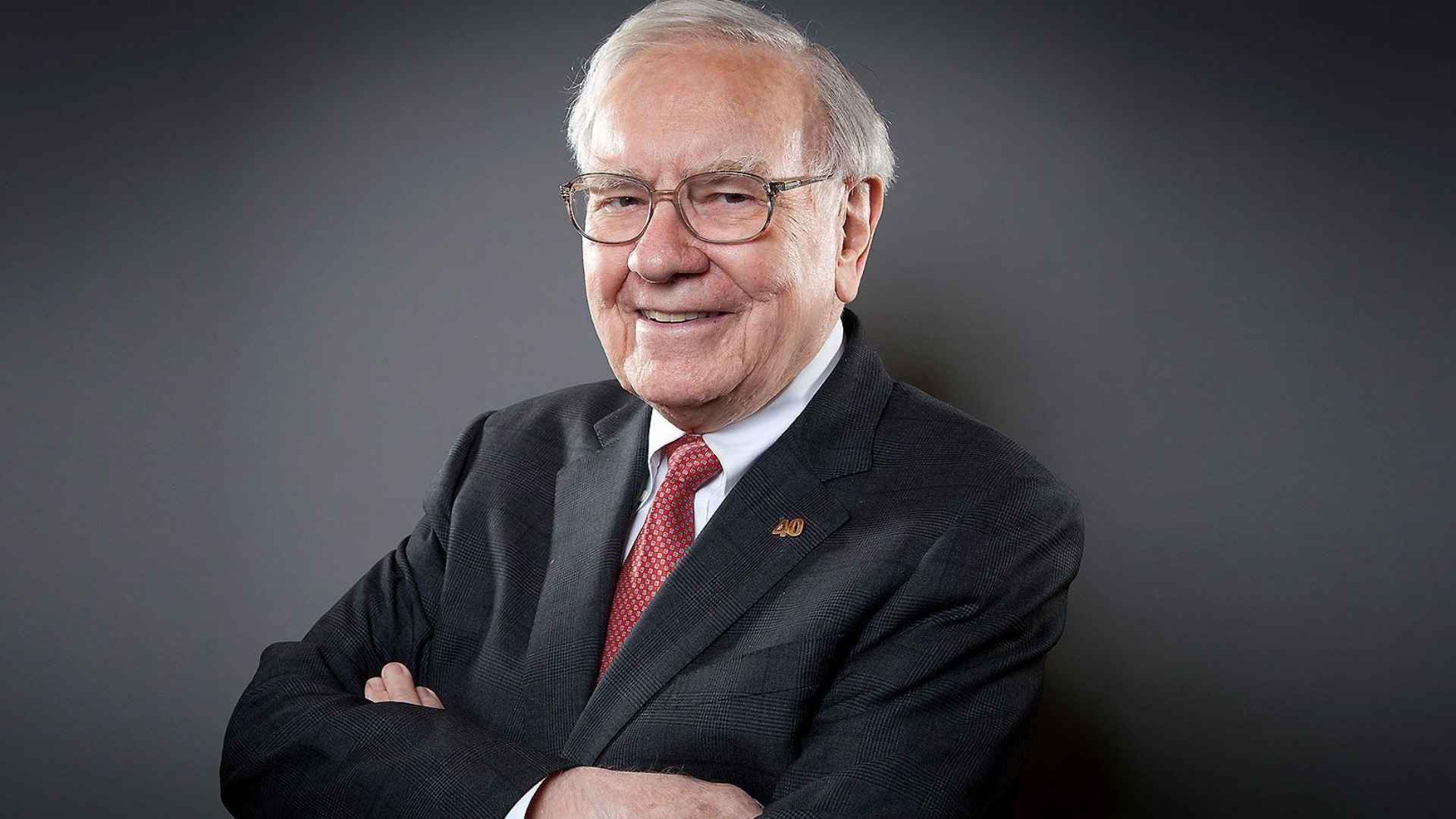

Warren Buffett once told CNBC that buying a primary home—and even scooping up distressed houses with 30‑year mortgages to rent—could be a standout move for hands‑on investors. In 2025, higher borrowing costs and pricier listings complicate that plan, but the core lesson still resonates.

In brief: mortgage rates now sit above 6.7% and typical home values hover near $369,000, about 0.5% higher than a year ago and more than 30% above pre‑pandemic levels. Many owners with sub‑4% loans aren’t selling, while a chunk of buyers stay parked on the sidelines. So what changed?

What Buffett told young investors in 2012 about buying homes

Coming out of the 2008 crash, prices had bottomed and 30‑year mortgages were around 3.5%. Buffett said he’d buy a home where he planned to live and, if he were handy, pick up a few distressed properties to rent. Even though he joked he wasn’t a fixer, his math was clear: cheap assets plus long‑term, fixed‑rate financing can be a powerful mix.

Is that play still realistic for first‑time buyers today? Why 2025 mortgage rates and prices complicate copy‑and‑paste strategies today? Today’s backdrop is tougher. Monthly payments are heavier, inventory is tight, and “cheap” is rare. The numbers tell the story:

| Factor | 2012 snapshot | 2025 snapshot |

|---|---|---|

| 30‑year mortgage rate | ~3.5% | Past 6.7% |

| Price environment | Post‑crash lows | Typical value ~$369,000 |

| Trend vs. prior year | Stabilizing | ~0.5% higher |

| Gap vs. pre‑pandemic | Not applicable | 30%+ higher |

| Market dynamics | Properties lingered | Sellers with sub‑4% stay put |

Bottom line: the same leverage that supercharged returns in 2012 can squeeze cash flow now unless rents and holding power comfortably cover costs.

What’s the workaround if you want real estate exposure?

How new fractional real estate platforms answer the landlord workload problem

Some platforms allow investors to buy fractional shares of rental homes—often with minimums as low as $100—while a third party handles tenants, maintenance, and paperwork. It isn’t the same as hunting individual bargains, but it addresses the “no‑wrench, long‑horizon” version of Buffett’s idea for those who value time and diversification.

Here are quick takeaways for would‑be landlords and investors:

- Leverage works best when assets are cheap and financing is low—unlike today.

- In 2025, stress‑test cash flow for vacancies, repairs, and rate surprises.

- Not handy or local? Consider professional management or fractional exposure.

- Keep horizons long; real estate is illiquid and cycles can be stubborn.

Run the numbers with conservative rent assumptions and realistic expenses. Compare buy‑and‑hold to fractional options and to simply waiting. If you proceed, favor fixed‑rate financing, ample reserves, and neighborhoods with stable demand. The opportunity remains—just not on 2012 terms.